As a community bank, West Gate Bank prides themselves on being there when their customers need them. During this uncertain time, they have helped customers utilize several online and digital products to maintain banking while being at home and social distancing. Customers can open a new personal or business checking or savings account online at their website, westgate.bank. From nearly anywhere or any time, they can access their account information with their free Mobile Banking app or Online Banking. Using  the West Gate Bank Mobile Mortgages app, customers can apply for a home mortgage loan or refinance.

the West Gate Bank Mobile Mortgages app, customers can apply for a home mortgage loan or refinance.

the West Gate Bank Mobile Mortgages app, customers can apply for a home mortgage loan or refinance.

the West Gate Bank Mobile Mortgages app, customers can apply for a home mortgage loan or refinance.West Gate Bank offers a variety of free checking accounts for personal and business use. The Completely FREE checking account is just that—an account with no minimum balance and no monthly service charge. Also offered are free accounts for customers age 50+, with interest (requires direct deposit or any automatic payment) and high interest checking. Business checking accounts offered are Completely Free Business Checking, Business Interest Checking, and Commercial Checking.

Want ultimate on-demand banking convenience? Online and Mobile Banking give you secure access to your accounts as well as a variety of free services that will simplify everyday money matters. With West Gate Bank’s free Online Banking service, you can keep track of your balances, deposits, and transactions whenever it is most convenient for you. As an Online Banking user, you have access to the full suite of online services that make managing your money even easier.

Up-to-date account information is at your fingertips with their free Mobile Banking app. Securely monitor activity and access account details (available for phones and tablets).* With multiple layers of authentication, you’ll never have to worry about the wrong people getting your information. A personal password and phone activation code keep your information safe.

Account Alerts provide free** personalized notifications—via email, text message, or push notifications—when specified checking, savings, and loan account activity occurs. These convenient, customized alerts are an easy way to monitor your account and reduce fraud.

Save time and deposit money without making an extra trip to the bank. Mobile Deposit is a free feature of the mobile app. Simply choose the account you’d like to deposit your check into, confirm the amount, take a picture of the front and back of the check, and submit.

Zelle® is a convenient way to send money using your mobile banking app or online banking account. Whether it’s saving you a trip to the ATM or taking out the guesswork of divvying up the lunch tab, Zelle is a fast, safe and easy way to send and request money. Funds are sent directly to the recipient’s account in a matter of minutes, and all you need is the recipient’s email address or U.S. mobile phone number.

External Transfers allow you to connect your accounts at other financial institutions to your accounts at West Gate Bank for easy money movement. It’s your money—move it when and where you need it.

You can count on West Gate Bank to keep you and your business running!

*Mobile device must have an OS that supports application downloads and may require a data service plan. **Cell phone provider may charge additional fees for web access or text messaging.

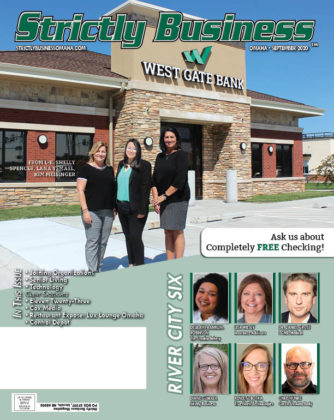

With 10 convenient locations in Lincoln and Omaha, West Gate Bank is a family-owned community bank. West Gate Bank is large enough to serve all your personal or commercial banking needs yet small enough to provide the outstanding personal service that only a community bank can deliver. Visit westgate.bank for account details, or stop by any of the locations to learn more.