Don’t forget that you may have a tax deduction waiting if you have an underfunded Health Savings Account and you act before April 15, 2013. A Health Savings Account (HSA) is a tax-favored account used in conjunction with an HSA-compatible health plan. The HSA allows you to contribute funds on a pre-tax or tax-deductible basis, which you may use to pay for eligible medical expenses.

Contribution Tax Benefits

If your employer offers a payroll deduction through a Section 125 Cafeteria Plan, you can make contributions to your HSA on a pre-tax basis. The deduction is removed from your paycheck prior to taxes being applied and deposited into your HSA. Ask your employer if they facilitate pre-tax deductions.

Contributions can also be made post-tax as an “above-the-line” deduction. This means you can reduce your taxable income by the amount you contribute to your HSA.

Tax Deduction for Contributions

Health Savings Account (HSA) contributions made by an eligible individual (or by a family member of the eligible individual) are an “above-the-line” tax deduction in determining the gross income of the eligible individual.

HSA contributions are deductible whether or not the individual is itemizing deductions. You cannot deduct HSA contributions as medical expense deductions. For purposes of recognizing your HSA deposits and distributions on your personal tax return, the IRS requires you to complete Form 8889.

Earnings Tax Benefits

The interest on HSA funds grows on a tax-deferred basis. And, unlike most savings accounts, interest earned on an HSA is not considered taxable income when the funds are used for eligible medical expenses.

When do you Pay Taxes on your HSA?

The only time you may pay taxes or penalties on your HSA funds is if you make a non-eligible purchase, or if you contribute more than the yearly maximum contribution limit. However, both misuses can be corrected free of tax penalties by April 15th of the following calendar year.

HSA Contribution Limits

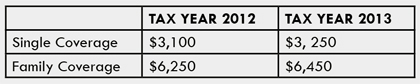

The maximum you may contribute to a Health Savings Account (HSA) is:

Catch-up Contributions

Individuals age 55 and over can make catch-up contributions.

Contribution Frequency

How often you make HSA contributions is completely up to you. You can make an annual lump sum contribution, you can make regular monthly deposits, or you can make multiple deposits in no particular order. Your bank or HSA administrator will always be pleased to accept your money.

A common mistaken impression is that HSA contributions must coincide with your health insurance premium payments (typically monthly, bi-monthly or quarterly). Not so.

HSA Contribution Deadlines

If you want to claim the HSA contribution tax deduction for a particular year, your HSA contributions must be made on or before that year’s tax filing date. For example, 2012 HSA contributions must be made on or before the April 2013 filing deadline.

HSA Contributions must be Cash

Health Savings Account (HSA) contributions must be in cash. Contributions cannot be made in stock or in other property.

Please note: these guidelines should not be the only source you use to make a decision and should not be considered legal or tax advice as that can only be provided by an attorney, CPA or other professional tax advisor.

If you would like to discuss potential health care insurance coverage and requirements it would be best to secure an appointment with one of the health insurance producers in UNICO Midlands who can provide additional help in the area of health care reform. For more information, give us a call today at 402-434-7200.

by Kipp Kissinger, 402-434-7200

UNICO Group, Inc. | www.UnicoGroup.com